ZhuoFan Samsung Galaxy A21s (4G) 6,5" desenli 2 adet bilek bandı kılıfı, el kayışı tutucu cep telefonu kılıfı boyun kılıfı yumuşak silikon darbeye dayanıklı koruyucu kılıf Samsung A21s için, yaprak : Amazon.com.tr:

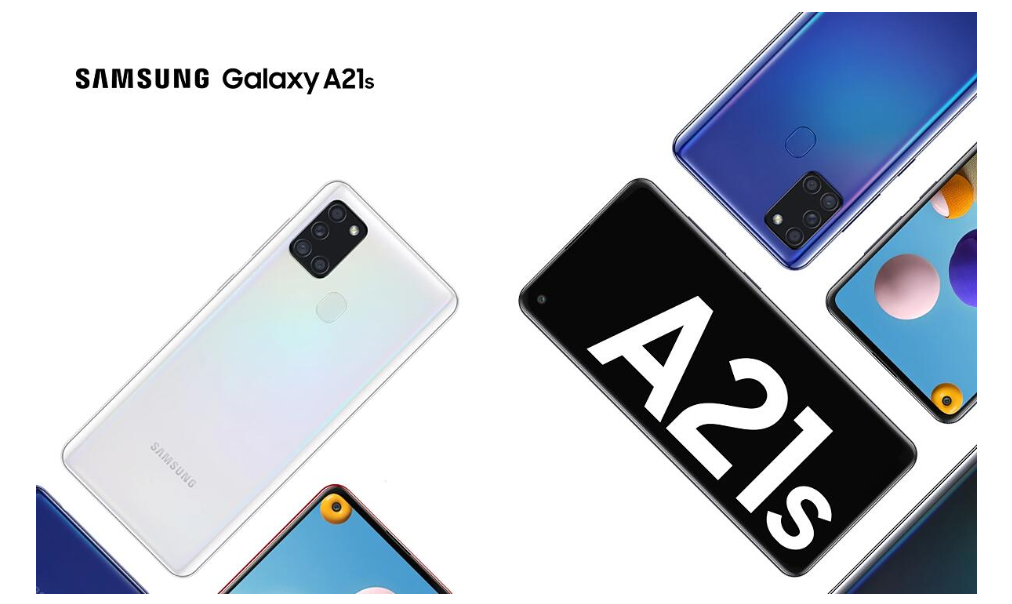

Yenilenmiş Samsung SM-A217F A21S 64 GB Mavi Cep Telefonu (1 Yıl Garantili) Fiyatı ve Özellikleri Kampanyaları & Fırsatları - Teknosa

ZhuoFan Samsung Galaxy A21s (4G) 6,5" desenli 2 adet bilek bandı kılıfı, el kayışı tutucu cep telefonu kılıfı boyun kılıfı yumuşak silikon darbeye dayanıklı koruyucu kılıf, Samsung A21s için, çiçek : Amazon.com.tr:

Samsung / Galaxy A21s / İLHAN İLETİŞİM'DEN 2.EL SAMSUNG A21S TEŞHİR ÜRÜNÜ FUL KUTULU sahibinden.comda - 1118840043

Samsung / Galaxy A21s / SAMSUNG A21 S 6+2 RAM 128 GB SIFIRDAN FARKSIZ... sahibinden.comda - 1088226754